Recently, it's been trendy online to rank everything from "banger" to "trash"; it seems everything can be rated on this scale. As a practitioner in the Web3 industry, the feeling of 2025 can be summed up in two words: "Acceleration". Having experienced world-shocking events like "Trump launching a coin", "Tariff wars", the "Genius Act", and "1011", it feels like since Trump took office, the entire capital market and crypto world have been put on fast-forward. What happened in the single year of 2025 equals the sum of events from the past 2-3 years. At the same time, as a content creator, I've almost consistently output one piece of in-depth content per month. But in these final days of 2025, rereading these pieces, I think some were well-written, while others fell short. So, at the end of 2025, I'll use the "from banger to trash" framework to rank my own articles.

1. Deconstructing the Real-World Dilemmas and Paradigm Shifts in the "Innovative Drug" Narrative Under the DeSci Framework

Author's Note

The DeSci narrative heated up around Q4 2024, and I personally always thought it was a "pseudo-narrative." Although CZ and Vitalik endorsed multiple token-launching Biotech projects, they aren't actually experts in life sciences. As a former investment manager at a Biotech VC with two years of experience, I probably understand innovative drugs a bit better than most crypto big shots. For example, after a team discovers a macromolecule for an innovative drug, it must go through Phase I, Phase II, and Phase III clinical trials—a 10-year cycle—which is completely misaligned with the investment pace of the crypto world. Therefore, I believe this narrative will eventually fade, becoming yet another aborted narrative in the crypto space. The title was discussed multiple times with former colleagues, and we ultimately settled on this relatively mild one.

Article Excerpt

"The author believes that the primary reason life sciences occupy such a high proportion within the DeSci industry is that after crypto industry opinion leaders accumulated sufficient wealth, all five levels of Maslow's hierarchy of needs were satisfied, leading them to focus more on issues related to life extension. From a fundamental logic perspective, there is a mismatch between DeSci in the Crypto field and real-world innovative drug development in terms of resources, timelines, and operations."

Article Sharp Review

Content Innovation: Four Stars

Content Reach: Three Stars

Content Re-evaluation: No change

Overall Rating: Top Tier (人上人)

2.Intelligent Innovation × Crypto Wave—How AIGC Empowers Web3 Content

Author's Note

This was a topic I really wanted to write about. The inspiration came from a project I saw during my VC days. It was July 2024, the peak of the Memecoin frenzy. Pump.fun had lowered the barrier to launching a coin to an extreme, so many startup projects revolved around Memes. One project that caught my attention was about collecting viral meme images; the platform used crawlers to grab memes from social media like X, then crowdsourced the launch of Memecoins. Its advantage lay in its data scraping speed and the platform's judgment on the price trends of meme coins after launch. This made me think that Memecoin issuance is also an assembly line: upstream is hot meme capture, midstream is the launch platform, and downstream are retail investors and market makers.

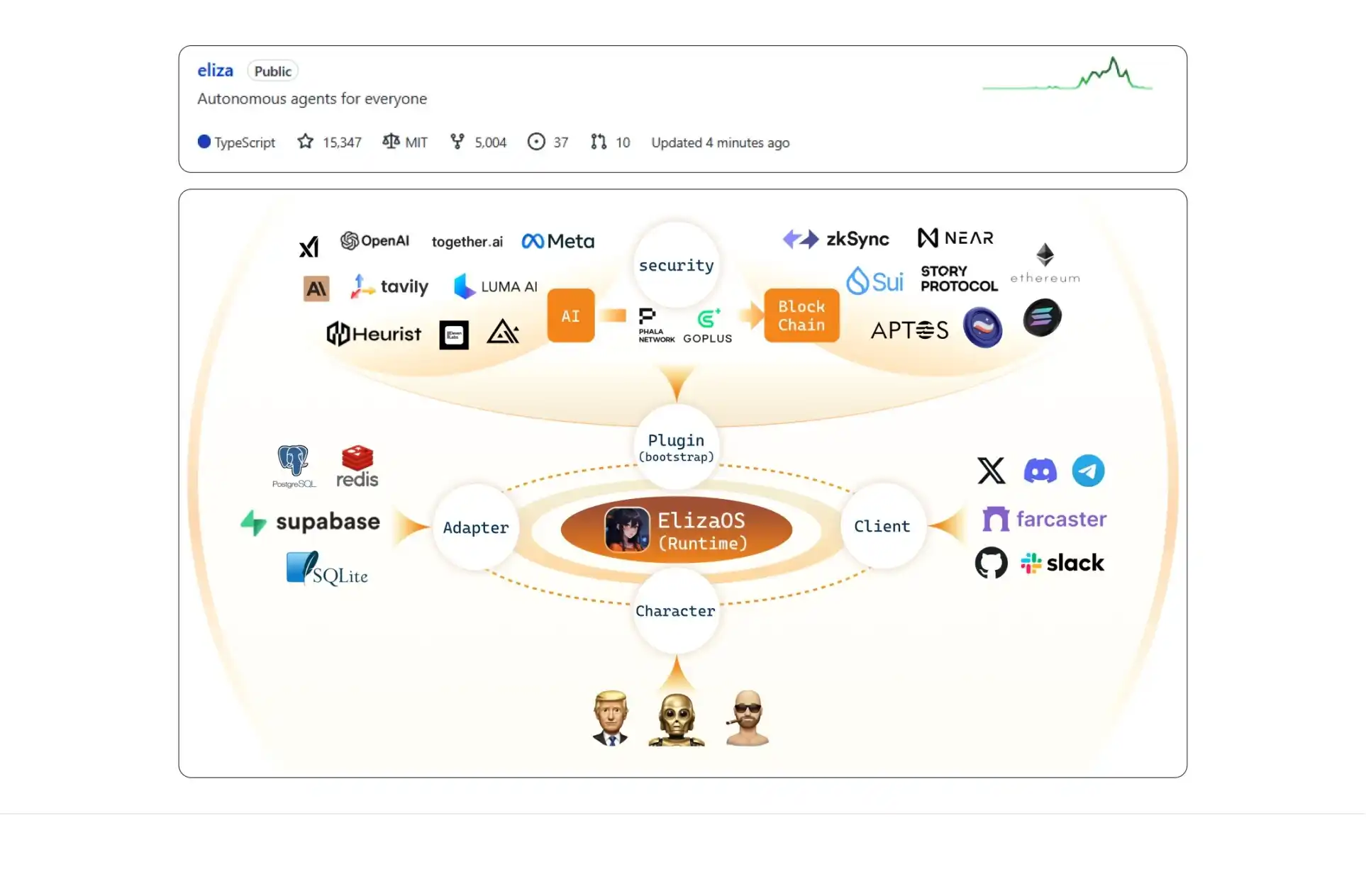

Later, coinciding with the explosion of DeepSeek in early 2025, I started thinking about how AI and Memecoins could combine. Memecoins, as cultural symbols, still need content support. So, I thought about the two-way relationship: AI empowering Memes, and Memes empowering AI. It's a bit like what the famous blogger Zhang Zala said: "Content productization" and "Product contentization." Using Nano Banana and GPT to generate content for PEPE is content productization; while some entertainment AI Agents like Luna represent product contentization. However, these don't allow the author or developer to generate economic benefits; a chain like Story is needed to distribute economic收益. Rereading this article, I feel many ideas were too idealistic, and the overall effect was mediocre.

Article Excerpt

"AIGC can not only赋予 existing Meme characters with content, but AIGC technology can also use Agents as a载体 to provide users with richer services. If AIGC empowerment for Memecoins is the 'old梗新说' (old meme, new telling) of Web3 content, then AI Agents represent a paradigm leap for AIGC technology from content production to service interaction."

Article Sharp Review

Content Innovation: Four Stars

Content Reach: Three Stars

Content Re-evaluation: Minus One Star

Overall Rating: NPC

3.In-Depth Analysis of the Impact of Tariff Policies on Bitcoin Mining

Author's Note

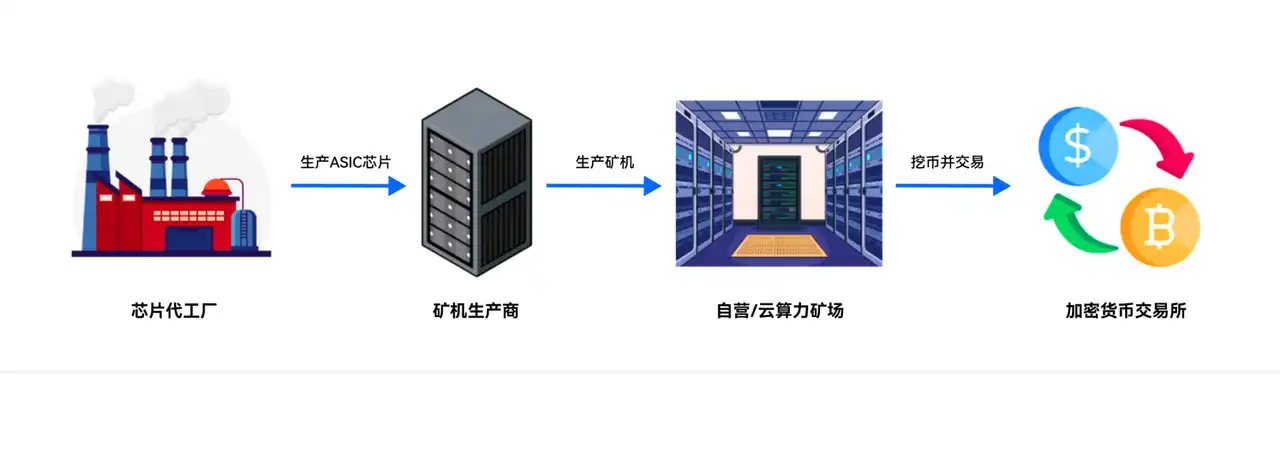

This was an assigned topic from my former company, against the backdrop of Trump's "crazy" tariff policies unsettling global capital markets. In this context, we were to analyze the impact of tariffs on the industry. As everyone knows, the part of the crypto industry most closely connected to the real economy is mining. The implementation of tariff policies had a huge impact on overseas mining farms in places like Iran, Uzbekistan, and Ethiopia. In terms of results, tariffs affected mining machines the most, followed by mining farms, and finally cloud hashrate platforms. Of course, Trump eventually rolled back most of the tariff policies, giving the capital market a scare.

My former company assigned me a small team of three people for this; the colleagues were very nice and hardworking. Maintaining that setup could have yielded a lot of quality content. This assigned topic was very time-sensitive; after the tariff policies passed, rereading this article offered diminishing returns.

Article Excerpt

After Trump announced the tariff policies, Bitcoin mining-related stocks fell by varying degrees, with different segments showing some divergence in performance. Mining machine manufacturers saw the most significant decline over the past month, primarily because mining machine manufacturing was hit by tariff policies on both the supply and demand sides. Self-operated mining farms were mainly affected on the supply side, while the business process of selling Bitcoin to cryptocurrency exchanges was less affected by tariffs. The leasing business model of cloud hashrate platforms naturally has a risk buffer mechanism—it essentially passes the cost of mining machines to customers through hashrate service fees, and some customers directly share the hardware investment through mining machine托管 agreements, making the erosion of mining machine premiums on platform profits significantly weaker than in traditional mining models.

Article Sharp Review

Content Innovation: Two Stars

Content Reach: Three Stars

Content Re-evaluation: Minus One Star

Overall Rating: NPC

4.The Underestimated High-Growth Sector: Searching for the Second Growth Curve of Oracles

Author's Note

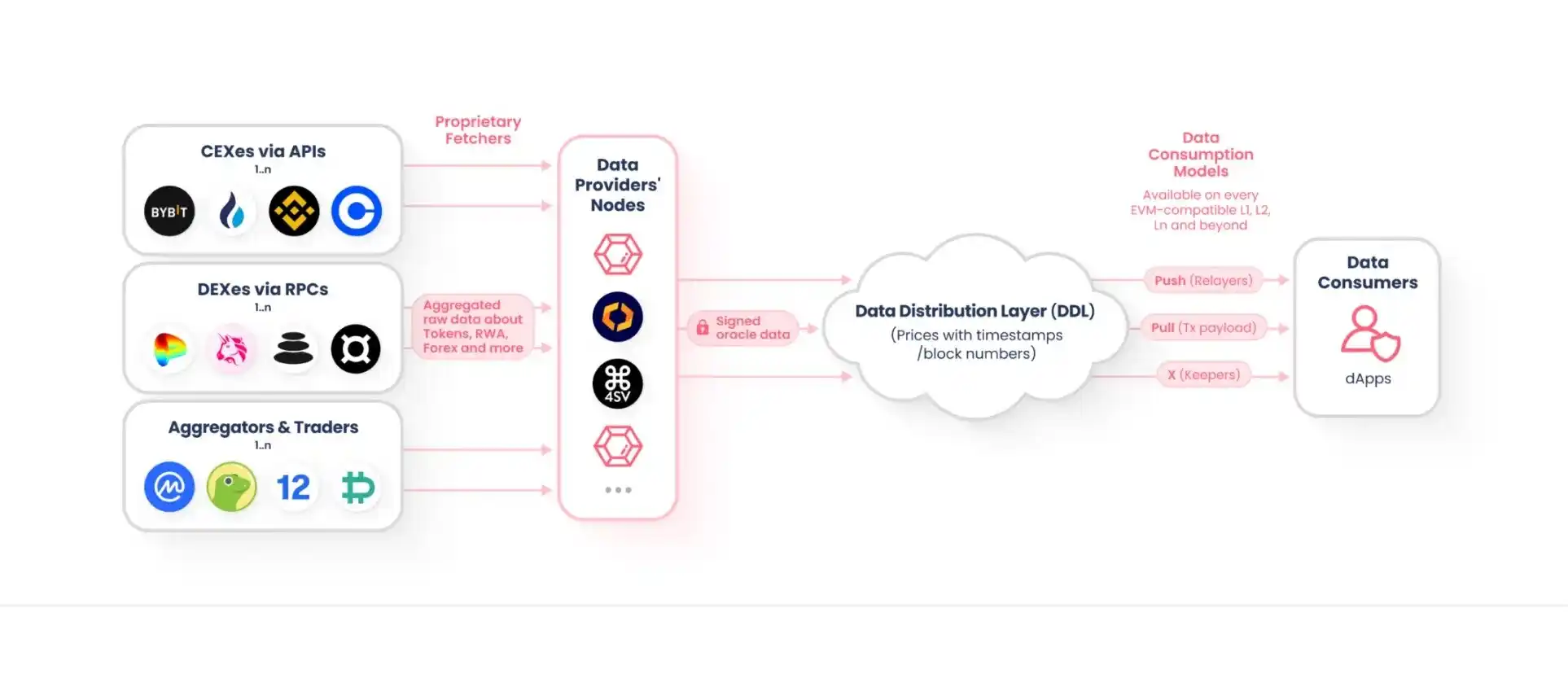

This was a topic chosen from the选题库 (topic pool). My former company required each researcher to produce 2 articles per month. The oracle topic is quite interesting; when I first entered the industry, there were many concepts I didn't understand, oracles being one of them. Because I had to write about this, I looked up a lot of information. Chainlink's moat in the "price feed"领域 is already quite deep; latecomers like Pyth, Redstone, and API3 find it hard to challenge. I still believe the future opportunity in the oracle industry lies in handling complex, non-standardized data, such as clinical data, industrial data, and code data, rather than traditional financial data. There seems to be little opportunity to challenge Chainlink in financial data. This piece reads a bit like routine work; I didn't particularly like it myself.

Article Excerpt

Non-financial assets refer to assets whose prices cannot be reflected in real-time and require mathematical modeling to reflect their value at a specific point in time. Examples include real estate, charging piles, photovoltaic modules, and artwork. Taking charging piles and PV panels as examples, users invest in tokenized assets through on-chain funds, but these cash flow assets are significantly affected by weather, environment, and equipment management, which may impact future cash flow distribution. For these non-financial assets, oracles need to provide more complex services, such as接入 data sources that reflect asset status and influencing factors (e.g., weather data, equipment operation data), and combine them with mathematical models to convert this information into credible on-chain prices or risk assessments, thereby supporting the valuation and management of non-financial RWA tokens.

Article Sharp Review

Content Innovation: Three Stars

Content Reach: Four Stars

Content Re-evaluation: Minus One Star

Overall Rating: Top Tier (人上人)

5. From General to Specialized: How Game Chains Reshape the Web3 Gaming Ecosystem

Author's Note

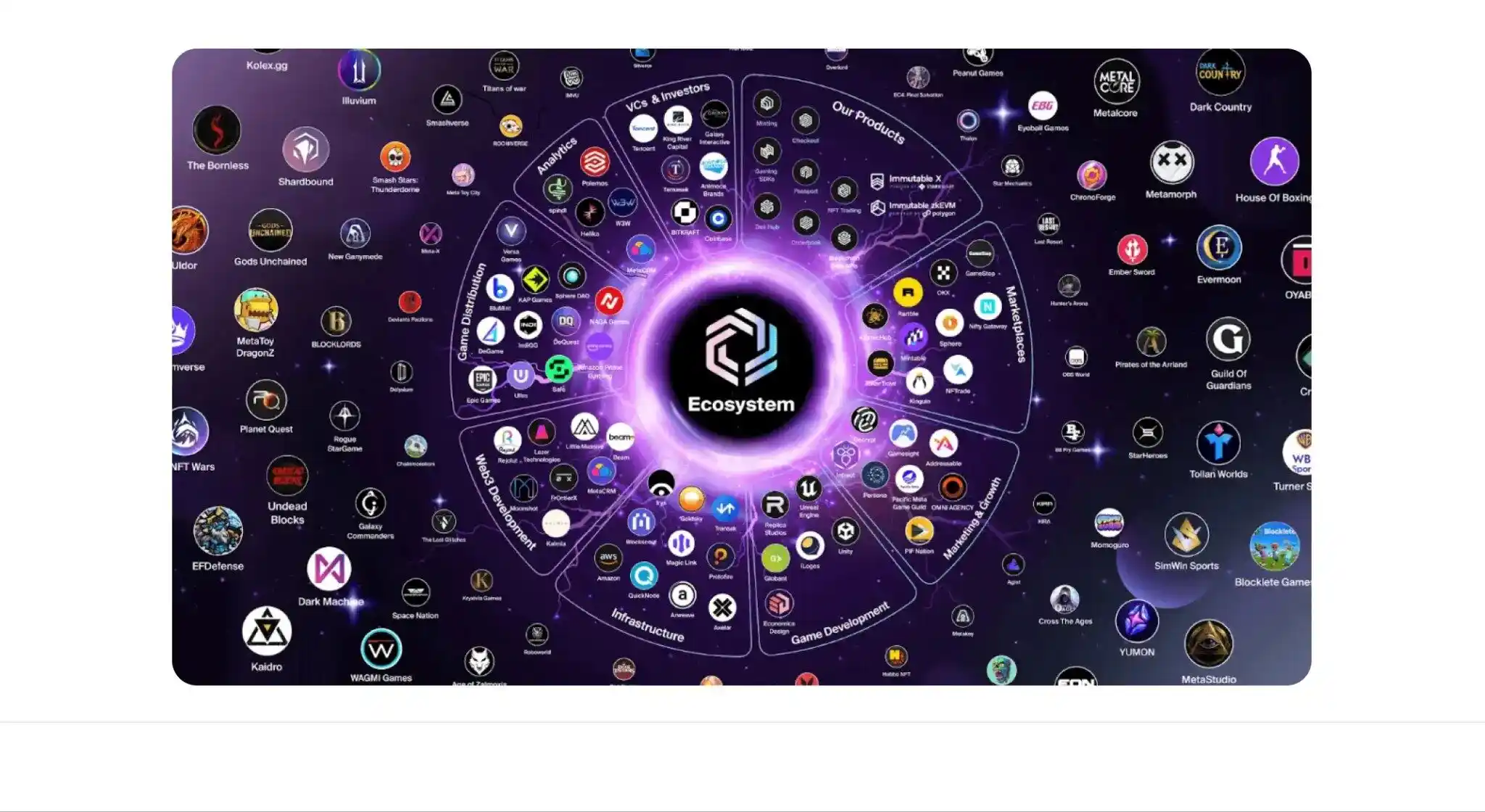

This was also a topic picked from the选题库. Gaming is an area I've always been interested in; I saw many gaming projects during my time as a Web3 VC. This article mainly analyzed some game-specific public chains, like WAX, ImmutableX, and Ronin, examining their game ecosystems and resource endowments. But what I completely didn't expect was that the entire GameFi sector, from games to公链, was very cold in 2025. IMX price dropped 82%, RON dropped 92%, SAND dropped 79%, all exceeding the decline of mainstream altcoins. Then again, Web2 gaming wasn't great this year, with no globally blockbuster hits released—no wonder Dembélé won the Ballon d'Or this year /(ㄒoㄒ)/~~ It's hard to say whether the crypto world dragged down gaming or gaming dragged down blockchain for the链游 sector's decline this year.

Article Excerpt

Gaming is a relatively new industry; Web2 online games have only been around for about 50 years. Looking at the development of Web2 games, high-quality game studios have the opportunity to grow into industry monopolies (like Blizzard Entertainment, Game Science), and internet companies with strong financial resources will also expand into gaming, becoming leaders in the industry (like Tencent, NetEase). The Web3 space has similar situations: Sky Mavis, with its hit game Axie Infinity, gradually advanced from a game studio to a giant in the Ronin game ecosystem; while general-purpose公链 like Polygon and OpBNB,凭借强大的资金实力 (relying on strong financial resources), have also released several influential games.

Article Sharp Review

Content Innovation: Two Stars

Content Reach: Three Stars

Content Re-evaluation: Minus One Star

Overall Rating: NPC

6.Hong Kong SFC First to Launch Ethereum Spot ETF Staking Services, Web3 Industry Sees Historic Breakthrough

Author's Note

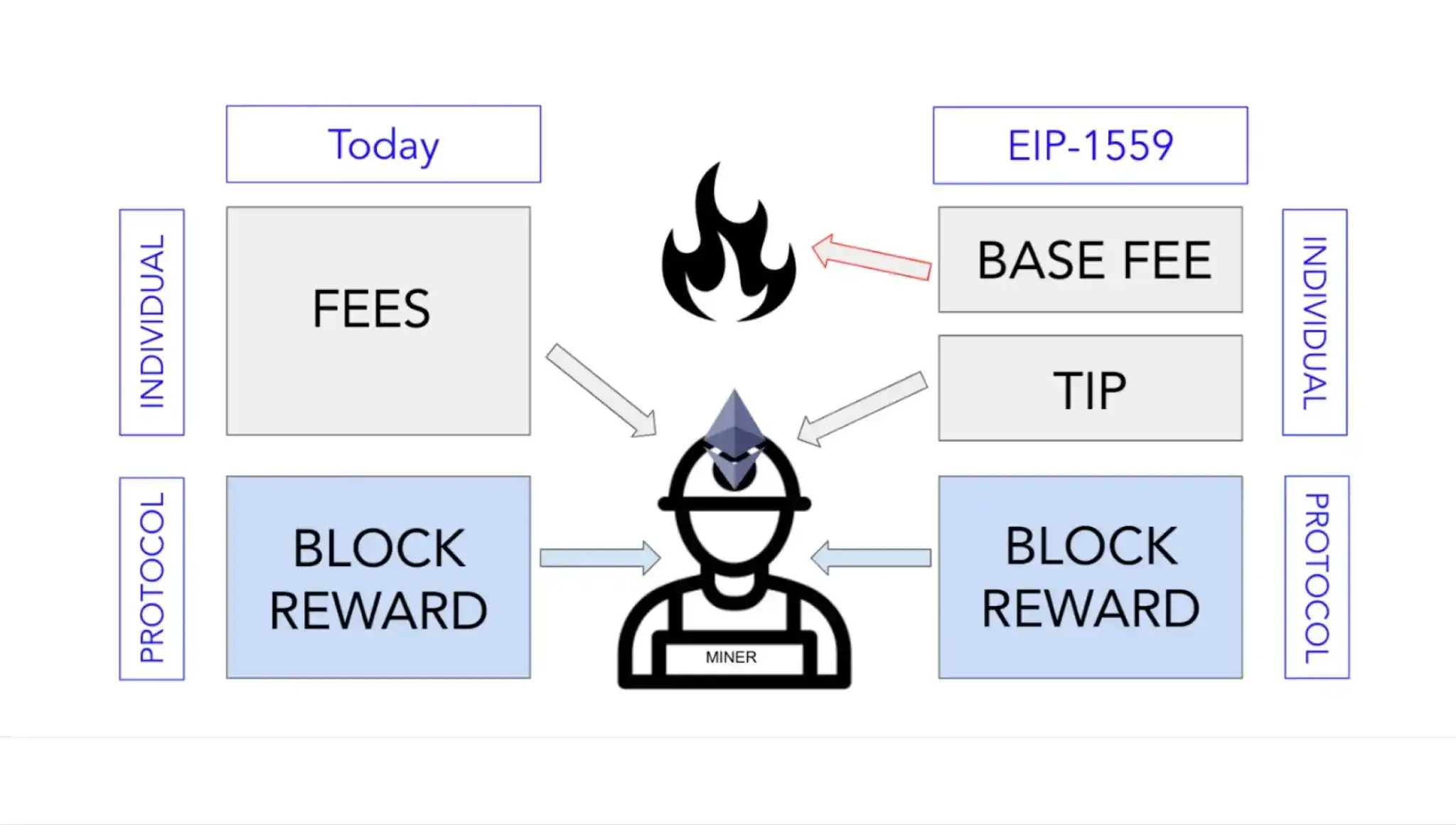

This was a topic closely related to policy. Hong Kong's Ethereum ETF offering staking services theoretically should be more competitive than US Ethereum ETFs without staking. But in reality, after this policy was introduced, not much net capital flowed into the several ETFs launched in Hong Kong; liquidity was still far lower than in the US. This was a short report, essentially introducing the benefits of Ethereum staking to readers. Looking back, the biggest gain from this article was probably learning more about the EIP-1559 proposal during research—turns out node rewards and transaction volume aren't completely linearly related.

Article Excerpt

Let's ask one more why: why has ETH staking yield continued to decline, significantly lagging behind SOL? The author believes the passage of EIP-1559 is an important reason. This proposal aimed to reduce ETH's inflation rate, further optimizing Ethereum's economic model. Before EIP-1559, nodes received the base fee + tips fee from on-chain transactions. After EIP-1559, nodes only receive the tips fee paid by transactors, while the base Gas fee is directly burned to ensure a stable deflation mechanism in ETH's economic model. Ethereum nodes and ETH stakers凭空 lost a significant chunk of revenue.

Article Sharp Review

Content Innovation: One Star

Content Reach: Three Stars

Content Re-evaluation: No change

Overall Rating: NPC

7. In-Depth Analysis of the Traffic War Between Letsbonk.fun and Pump.fun

Author's Note

This is one I consider poorly written. Because there were fewer new narratives in July this year, there weren't many topics to write about. Letsbonk.fun was yet another challenger to Pump.fun at the time, but the platform incubated by Bonk was overall quite immature, with relatively simple UI and product structure—it couldn't compare to a complex product like Pump.fun from a product dimension. The reason for comparing the two was that Letsbonk.fun had跑出了一些“金狗” (produced some "golden dogs"), causing its Memecoin launch volume to surpass Pump.fun's for a few weeks.

Article Excerpt

As a latecomer in the one-click coin launch space, the core difference between Letsbonk.fun and Pump.fun lies in their driving forces. Letsbonk.fun's initiator, Tom, is also the initiator of the Bonk token, highly skilled in the community-driven Memecoin growth playbook. Pump.fun, as the pioneer of one-click launches, is primarily code and technology-driven, turning coin launches into a convenient tool. Pump.fun's on-chain address多次 transferred SOL to the centralized exchange Kraken, drawing community backlash. Letsbonk.fun announced an incentive plan for Memecoin project方 upon platform launch, sharing launch profits with community users.

Article Sharp Review

Content Innovation: Two Stars

Content Reach: One Star

Content Re-evaluation: Minus One Star

Overall Rating: Total Trash (拉完了)

8.2025 H2 Meme New Narrative Guide

Author's Note

This was a piece I had high hopes for. At my former company, I wrote 12 long articles in total, 4 of which were related to Memecoins. Actually, many readers want to find the next PEPE, the next BOME, though we all know the probability is very low, similar to scratching a lottery ticket. In 2024 and 2025, many cultural symbols and AI symbols also became hot Memes, like Wukong, Nezha, Grok, etc. So this piece attempted to establish a methodology, letting readers know about potential hot events in advance, so if a "golden dog" appears, they might have a better chance of not missing out. But from the results,这类翻超过 10 倍的域名型 Meme (this type of domain-name Meme that surged over 10x) never appeared again on链 scanning tools like GMGN, also reflecting that the altcoin market was relatively cold in the second half of the year.

Article Excerpt

But for retail investors, the first wave of opportunities for KOL-driven Memecoins is extremely difficult to catch, while another type of Meme's market opportunity is easier to predict. These are Memes that are the on-chain embodiment of real-world火爆 concepts. Because IP itself is not a physical asset and cannot be mapped on-chain through RWA, they can only bring the heat on-chain through Memecoins. Representative examples are Memecoins related to the game "Black Myth: Wukong," the movie "Nezha," the large model "DeepSeek," and "Grok."

Article Sharp Review

Content Innovation: Five Stars

Content Reach: Three Stars

Content Re-evaluation: No change

Overall Rating: Top Tier (顶级)

9. Analyzing the Dual Relationship Between Listed Companies and Cryptocurrency

Author's Note

The big background for writing this was the热度 (buzz) of DAT (Treasury Companies) soaring in the second half of the year. Many listed companies copied MSTR's method, forming DATs with underlying assets like BNB, ETH, SOL, HYPE. Some friends from my private equity days also consulted me on how this thing actually works. This article was originally a guide teaching listed companies how to buy coins. For example, companies with poor main business wanting to use convertible bond financing to transform into a DAT and turn things around should最好囤 SOL or ETH, as staking rewards can cover financing costs. Others with stable cash inflows, like insurance companies, can囤 BTC or LTC; mining coins are类似于黄金和白银 (similar to gold and silver), a type of reserve asset. On the other hand, the Solana Foundation is also looking for the most suitable listed company to play the role of MSTR for the SOL token. Therefore, token project方 also have demands for listed companies to囤币. Ultimately, the title became about this dual relationship between the two. I'm relatively satisfied with the final presentation.

Article Excerpt

Staking yield can be analogized to stock dividend yield. From the needs of listed companies, the demand to become PoS token囤币商 (hoarding merchants) mainly falls into three categories: (1) Obtain high staking yield, covering financing costs while generating positive cash flow. (2) Obtain high asset appreciation, driving stock price growth. (3) Occupy a core position in the ecosystem, strategically布局 around the public chain ecosystem. Pursuing high staking yield: SOL has high staking yield,公链 has stable transaction volume; Pursuing value growth: HYPE has a transaction fee buyback mechanism, token price has already achieved 10x growth; Pursuing ecosystem layout: ETH has high decentralization, Layer2 development difficulty is low.

Article Sharp Review

Content Innovation: Three Stars

Content Reach: Four Stars

Content Re-evaluation: Plus Half Star

Overall Rating: Top Tier (顶级)

10. Thoughts on Exodus Issuing Tokenized Stocks On-Chain

Author's Note

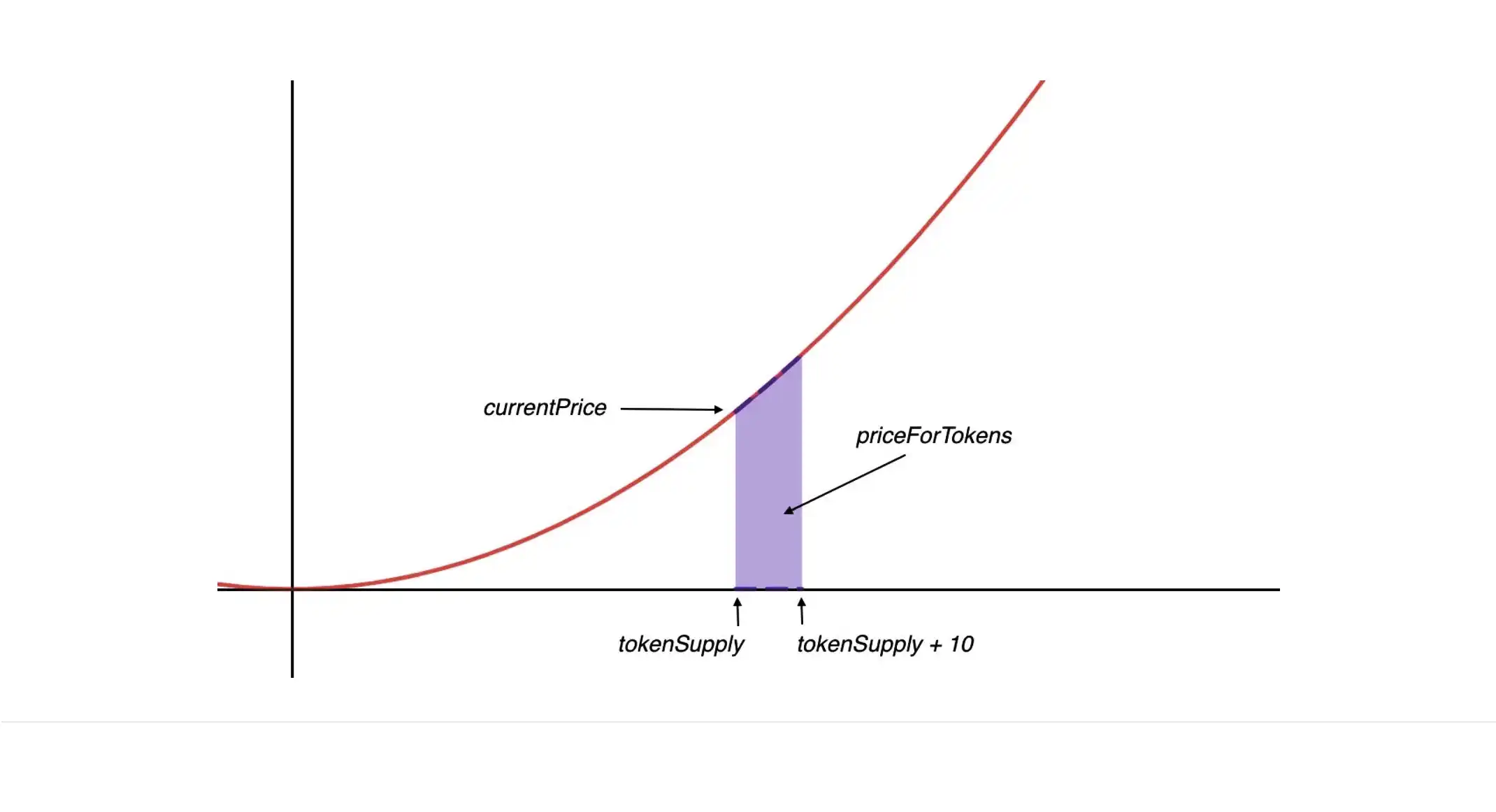

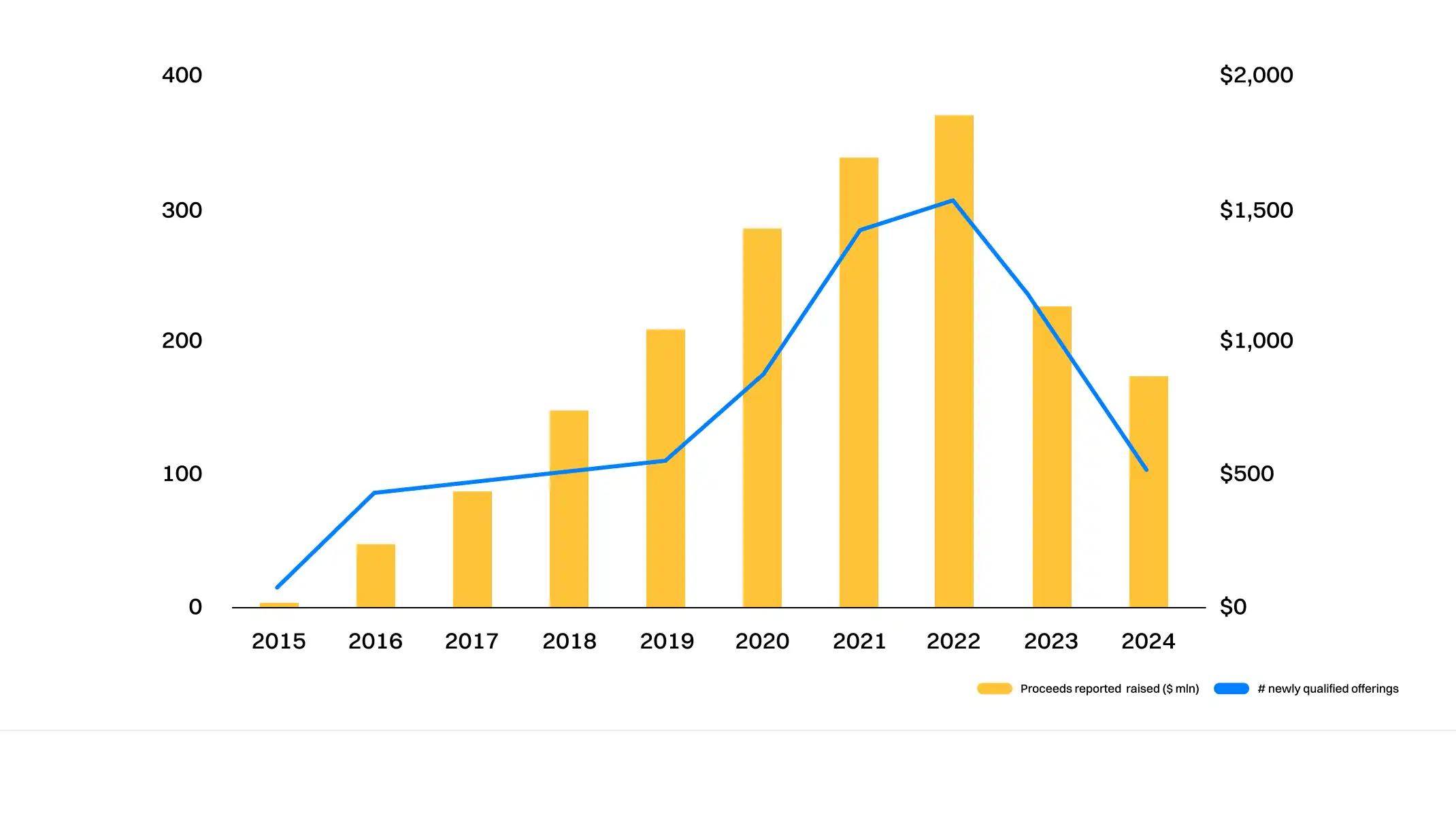

The catalyst for writing this was the stock tokenization narrative becoming very hot in the industry in July. xstocks and Robinhood both launched stock tokenization products and increased marketing efforts. Looking at data from RWA.xyz, actually well-known companies like Tesla, Nvidia, Oracle, Apple, and Google are not the largest by scale. The largest is the stock of Exodus. They passed the SEC's Regulation A, and their IPO financing was directly through token issuance, taking on-chain liquidity instead of traditional cornerstone and anchor investments. This sparked a lot of thought. Among the four methods—Pre-IPO, IPO,定向增发 (private placement), and direct tokenization of large company stocks—the company, the platform, and users all have different demands.

Article Excerpt

Listed companies, especially US-listed companies related to cryptocurrency (like Circle, Coinbase, Marathon) conducting增发融资 (additional issuance) of tokenized stocks on-chain, can补充流动性 (supplement liquidity) for the enterprise for business expansion or investment and acquisition; for investors, they can get a lower price than the secondary market and opportunities for on-chain yield generation. The author believes this area will be a key future development direction for stock tokenization.

Article Sharp Review

Content Innovation: Four Stars

Content Reach: Two Stars

Content Re-evaluation: No change

Overall Rating: Top Tier (人上人)

11. 2025 Hyperliquid KOL Influence Report

Author's Note

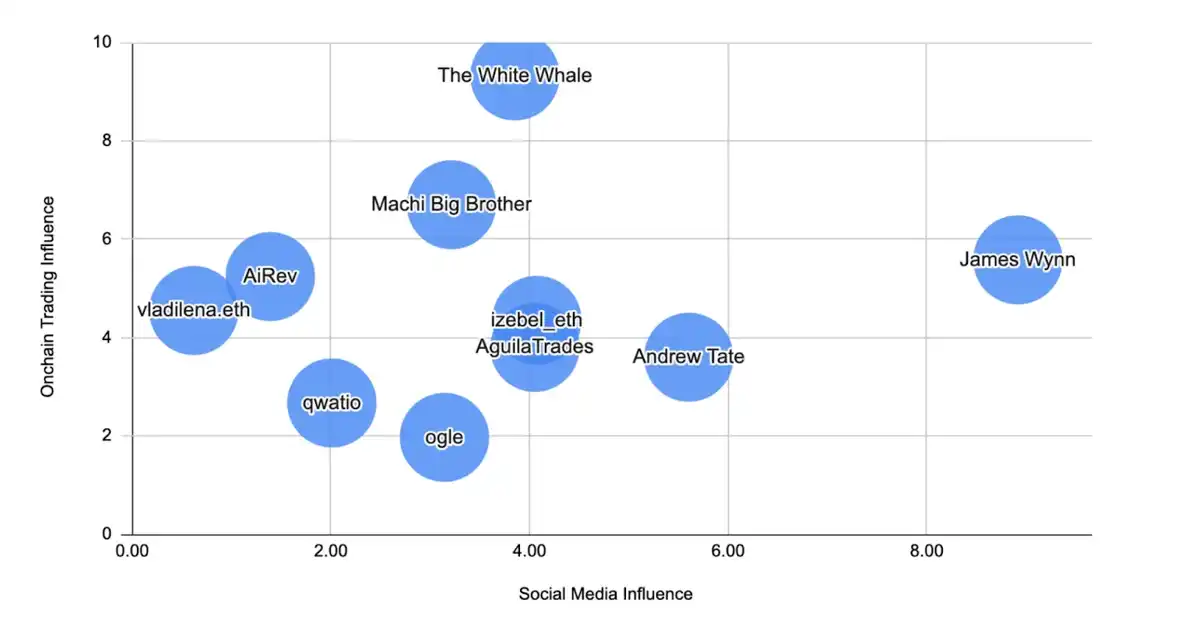

I consider this a very good piece, and it took a lot of effort. Hyperliquid and Pump.fun were the two biggest narrative highlights of 2024, both playing social media + trading perfectly—the former through X, the latter through a live streaming section embedded in the platform. Hyperliquid has so many trader KOLs, so which ones have higher win rates? I found a lot of data on the Hyperdash website and compiled a list of these people's publicly known wallet addresses. This was also the first article I wrote as an independent researcher, actually created during my tenure at the former company.

Article Excerpt

Focusing on KOLs who have bound their personal IP, two typical persona strategies can be observed: "Loss Whale" and "High Win Rate Smart Money." The former attracts market attention by crafting a narrative of "huge wealth fluctuations," leveraging dramatic events; the latter attracts investors to copy trades with the core of verifiable high win rates, hoping to replicate their excess returns. It is worth emphasizing that The White Whale successfully broke through the common "scale curse" in asset management, possessing both顶级资产规模 (top-tier asset scale) and high win rates, thus becoming a benchmark IP in the Hyperliquid ecosystem that combines influence and profitability.

Article Sharp Review

Content Innovation: Four Stars

Content Reach: Three Stars

Content Re-evaluation: Plus One Star

Overall Rating: Banger (夯)

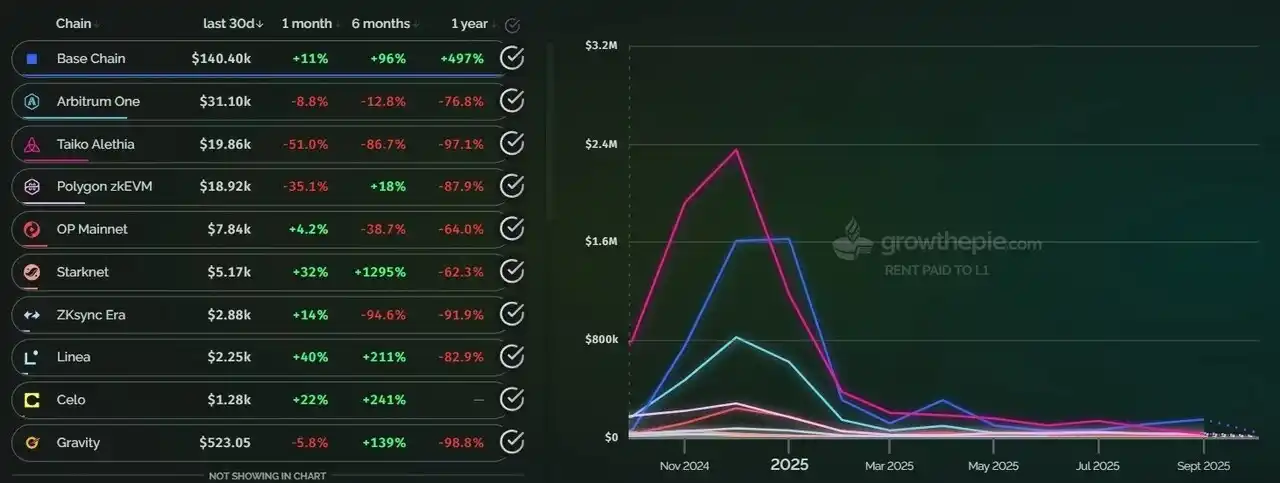

12. Is Building Your Own Layer2 Chain the Ultimate Strategy for Ethereum DATs to Increase mNAV?

Author's Note

This was also a topic I had in reserve for a long time. Actually, the explanation of the ETH part in "Analyzing the Dual Relationship Between Listed Companies and Cryptocurrency" already hinted at this. For this wave of DATs, many companies haven't really figured out which coin to囤 to achieve which strategic goals. The ceiling for囤 ETH is actually the highest because building a Layer2 has become very easy. If a listed company has a lot of accumulated C-end users, it could完全可以做转化 (completely do conversion), turning some of these users into users of its own chain. Of course, this is just armchair theory; to actually achieve good conversion, many user incentive activities need to be pushed to attract users to the chain. Ultimately, this article was even made into a video by小伙伴 on B站 (Bilibili), and was reposted on Binance Square and Bitget Square, far exceeding my expectations in terms of reach. The host of the "Web3 101" podcast also later mentioned the possibility of Ethereum DATs building their own Layer2s.

Article Excerpt

Staking is currently the most commonly used asset appreciation method for crypto treasury companies, and this approach has gained widespread market recognition. But for Ethereum treasury companies holding ETH,仅仅使用第三方平台对 ETH 进行质押与借贷 (仅仅 using third-party platforms for ETH staking and lending) limits ETH to a financial asset and fails to leverage the high scalability of the Ethereum mainnet at a technical level, losing strategic opportunities. Building their own Ethereum Layer2 network is a fundamental strategic leap for treasury companies. Although it will incur higher capital expenditures for the treasury company, the core value of this decision lies in promoting the company's transition from a "holder" of crypto assets to an active "builder" of the blockchain ecosystem.

Article Sharp Review

Content Innovation: Four Stars

Content Reach: Five Stars

Content Re-evaluation: Plus Half Star

Overall Rating: Absolute Banger (夯的批爆)

Epilogue

2025 is almost over. This year, I wrote articles big and small, including daily, weekly, monthly, and annual reports on the blockchain industry at my former company. After the restructuring at my former company, I also wrote quite a few PR copy. For me, transitioning from Web3 VC to creator, I probably never wrote this much content in the previous 5 years of work. This is my 13th creation in 2025, and also a yearly journal for 2025. If I had to include this piece in the "from banger to trash" ranking, I'd give it a "Top Tier" (人上人), PUA-ing myself to learn more new things next year and produce some better content. Although next year might be the worst year in the four-year cycle, creators continuously evolving with AI will definitely form their own brand and moat.